- #Irs e file extension 2016 full#

- #Irs e file extension 2016 verification#

- #Irs e file extension 2016 download#

- #Irs e file extension 2016 free#

If you filed prior to the deadline, but were rejected, you will likely have until April 22 to mail in your extension. Payment and mailing instructions are on pages 3 and 4 of your printout.

#Irs e file extension 2016 download#

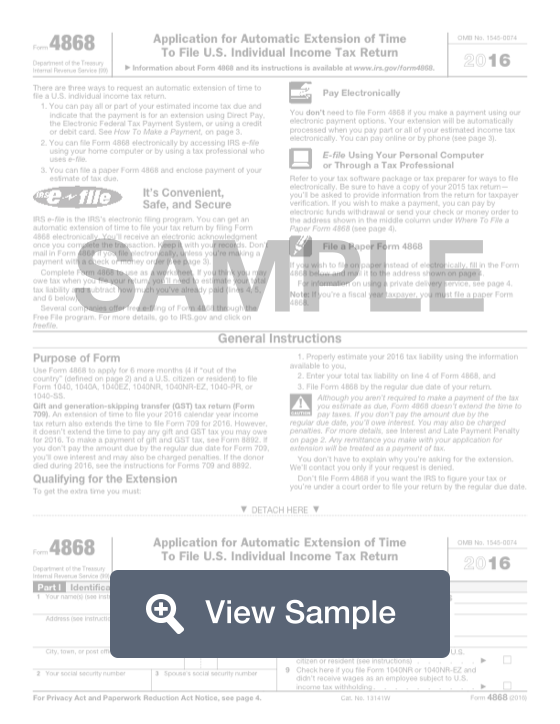

Download and print Form 4868, fill it out, and get it postmarked before 11:59 p.m.Recommended: Pay your taxes at IRS Direct Pay (this also automatically gives you an extension).If you don't have your AGI, or your extension gets rejected for the wrong AGI, here are 2 options:

#Irs e file extension 2016 verification#

Note: If you're paying additional taxes owed with direct debit, you'll need to provide your 2020 AGI for verification purposes (if you didn't file a 2020 return, enter 0 as your AGI).

#Irs e file extension 2016 free#

Estate or Trust Declaration for an IRS e-file Return 2016 Form 8453-C: U.S. Individual tax filers, regardless of income, can use Free File to electronically request an automatic tax-filing extension. (You'll still owe interest if you pay after the deadline). Foreign Corporation Income Tax Declaration for an IRS e-file Return 2016 Form 8453-FE: U.S. Keep in mind: An extension doesn't give you extra time to pay your taxes - but it will keep you from getting a late filing penalty. It isn't possible to file a post-deadline extension. If your extension is rejected by the IRS, we will provide you with both a reason for the rejection and the option to correct and retransmit the extension to the IRS at no additional cost.IRS extensions for tax year 2021 must be filed on or before April 18, 2022 for domestic taxpayers. Once the IRS processes your extension, we will notify you of the filing status by email. > You can then review the Form summary, and E-file it with the IRS.

> You can choose to pay the balance due to the IRS using EFW, Check or Money Order. > Enter the estimate of total income tax payment and balance due, if any. > Enter your Personal Details such as Name, SSN, and Address. > Select the extension type you would like to file.

> Simply download our app, and log in to your ExpressExtension account. Get started with ExpressExtension, an IRS-authorized e-file provider for IRS tax extension forms, and e-file your Form 4868 for an automatic extension of time to file your personal income tax return.ĮxpressExtension provides a user-friendly, step-by-step filing process that helps you to file tax extension Form 4868 in minutes with the convenience of our mobile app. However, if form 4868 gets rejected for any other reason, users have the option to correct and resubmit at no additional cost. We recommend that preparers transmit electronic files to Thomson Reuters at least one hour before the filing deadline. The IRS almost never makes any inquiries as to why you are asking for the extension, so almost everyone who files is granted one, so long as they dont owe back taxes for multiple years. Estate or Trust Declaration for an IRS e-file Return 2016 Form 8453-C: U.S. (Youll still owe interest if you pay after the deadline). If you are not prepared to file your taxes when April 15th comes around, you can apply for an extension to file. IRS e-file Signature Authorization for Application for Extension of Time to File Form 4868 (SP) or Form 2350 (SP) (Spanish version) 2016 Form 8878: IRS e.

Keep in mind: An extension doesnt give you extra time to pay your taxes but it will keep you from getting a late filing penalty.

It isnt possible to file a post-deadline extension.

#Irs e file extension 2016 full#

In addition, ExpressExtension offers an Express Guarantee this tax season, meaning any user who files a Form 4868 and receives an IRS rejection stating duplicate filing will get a full refund. For filing deadlines and other information related to 1041 electronic filing, refer to IRS Publication 4163, Modernized e-File (MeF) Information for Authorized IRS e-file Providers for Business Returns. IRS extensions for tax year 2021 must be filed on or before Apfor domestic taxpayers. The IRS suggests that individuals e-file their extension Form 4868 both for faster processing and the ability to get instant approval. Form 4868 provides an automatic 6-month extension of time to file the 1040 income tax return with the IRS. Individuals that need more time to file their income tax returns can apply for an extension using Form 4868. individuals must file their income tax return 1040 with the IRS this year by May 15.

0 kommentar(er)

0 kommentar(er)